Hemophilia stands out among rare genetic diseases for its significant therapeutic advancements, closely tied to substantial financial investments. Key factors driving this progress include severe hemorrhagic consequences from an early age, its impact on royal families, the HIV and hepatitis C contamination tragedies, the identification of factor VIII (FVIII) and FIX genes, and advancements in biotechnology. Maintaining low, measurable concentrations of FVIII or FIX in the blood has proven pivotal in improving patient outcomes. The mobilization of the global hemophilia community, led by the World Federation of Hemophilia, the European Association for Haemophilia and Allied Disorders, and the National Bleeding Disorder Foundation, has continuously advocated for access to safe, effective treatments. With reinvestments from biopharmaceutical partners, revolutionary options, including gene therapy, have emerged. However, this cycle of innovation and investment, essential for curing all patients worldwide, faces potential threats. This article aims to highlight the critical importance of investing in hemophilia treatment and research, a topic of concern for all stakeholders within the hemophilia community.

Essentials

Sustainable investment cycle

Financial resources should both attract investors and encourage innovation while also supporting global access through modest altruistic initiatives.

Balancing innovation and access

Although high treatment costs drive investment in innovative therapies, a better balance is needed to ensure affordability and accessibility.

Expanding global access

Lowering treatment costs per patient is essential to making prophylaxis available to a larger number of patients worldwide.

Encouraging market participation

Biopharma companies should engage in country-specific tendering processes to improve affordability and accessibility.

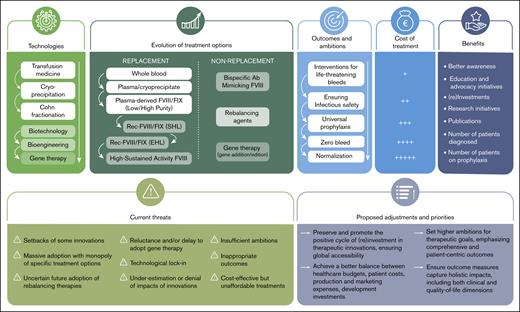

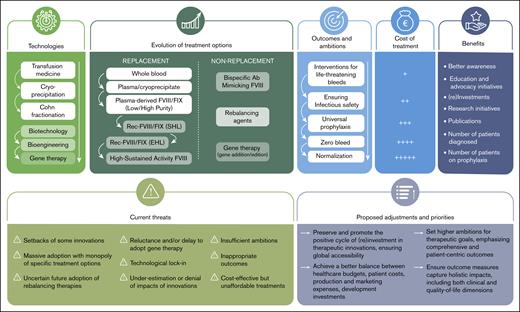

Hemophilia treatment: evolution and revolution

Significant advancements have transformed hemophilia treatment over recent decades.1-3 These developments were primarily motivated by the underlying pathophysiology of hemophilia and its severe hemorrhagic complications. In theory, the therapeutic goal is straightforward: hemophilia is a deficiency disorder involving a partial or complete inability to produce functional blood coagulation factor VIII (FVIII) or FIX. The original treatment, known as substitution or replacement therapy, aimed to compensate for the missing clotting factor. Predictably, early substitution therapies involved blood products from nonhemophilic donors, such as whole blood, plasma, cryoprecipitate, or partially purified factor concentrates derived from human plasma, administered IV to patients with hemophilia (Figure 1).3 Despite initial successes, these early approaches were tragically marred by the transmission of HIV and hepatitis C viruses3 to thousands of patients.4

The positive cycles of therapeutic innovations in hemophilia: successes, threats, and priorities.

The positive cycles of therapeutic innovations in hemophilia: successes, threats, and priorities.

Although the introduction of viral inactivation processes was pivotal in enhancing the safety of blood-derived factor concentrates, the real breakthrough in hemophilia treatment came with the identification and characterization of the FVIII and FIX genes in 1984 and 1982, respectively, enabling the production of synthetic, or recombinant DNA-produced FVIII and FIX concentrates.3 Biotechnology-based production of these clotting factors offers numerous advantages: synthetic concentrates are free from infectious risks, available at large scales, and stored and delivered in compact volumes. These properties have greatly facilitated wider access to treatment and the establishment of prophylactic regimens to prevent bleeding episodes.5 However, these “added values” of synthetic concentrates have come with higher charges to patients than plasma-derived options, reflecting the substantial investments required for their research, validation, and production. These products are typically priced higher than their predecessors because they aim to provide superior efficacy, improved safety, or both. High-priced biotechnology products in hemophilia and other diseases reflect not only the cost of innovation but also the application of value-based pricing.6

Despite the advent of synthetic production for first-generation factor concentrates, biotechnology initially failed to resolve 3 major challenges in hemophilia treatment: the necessity for IV administration, the short half-life due to rapid clearance of administered clotting factors, and their immunogenicity. Partial progress has been made on one of these fronts by modifying the structure of biotechnologically produced FVIII and FIX to slow their elimination and extend their half-life. This has been accomplished through various technologies, such as fusion with endogenous proteins (such as albumin or the Fc fragment of immunoglobulin G) or PEGylation, commonly used in other therapeutic fields.7 Although these advances initially showed more promise for FIX than FVIII, the recent development of an “ultralong” (UL) or “high-sustained activity” von Willebrand factor–independent FVIII, allowing for once-weekly administration and high trough levels, has helped to rebalance the treatment landscape for hemophilia A and B.8-10 Nonetheless, the other 2 challenges in FVIII and FIX replacement therapy, IV administration and immunogenicity, have remained unsolved by biotechnology.

Advances in monoclonal antibody drug research has recently provided a breakthrough in hemophilia A treatment. One of the most significant and innovative recent advancements has been the development of a bispecific antibody that mimics the cofactor function of FVIII.11-13 This subcutaneous therapy, administered as infrequently as once every 4 weeks, offers continuous hemostatic activity and is unaffected by antibodies against FVIII, making it the preferred option for many patients with moderate to severe hemophilia. Although this treatment achieves a partial correction of the hemostatic defect that effectively prevents most spontaneous bleeds (∼15% FVIII equivalence), it may still require supplemental FVIII therapy during major invasive procedures or severe trauma.14 This antibody has established itself as the reference prophylactic therapy for many patients with hemophilia A, both with and without inhibitors, particularly benefiting those with inhibitors or those unable to self-administer IV FVIII concentrates. In only 7 years, it has captured over half the patients with severe FVIII deficiency in many high-income countries.15

At the same time, several subcutaneous therapies that partially neutralize or reduce physiological coagulation inhibitors, called rebalancing agents, such as a small inhibitory RNA to antithrombin and anti–tissue factor pathway inhibitor monoclonal antibodies, have shown promise in clinical studies, with some now commercially available.16 These treatments offer a new avenue for treating both patients with hemophilia A and B, regardless of the presence of antibodies against FVIII or FIX. In addition, significant progress has been made in gene therapy, an entirely new technology arena, particularly for hemophilia B.17,18

Treatment innovations of hemophilia: financial investments and reinvestments

These therapeutic advancements have required substantial financial investments. Initially, this was driven by the need to ensure the safety of plasma derivatives, followed by the high costs of developing and validating synthetic clotting factor concentrates through biotechnology. The cost of hemophilia treatment has long mirrored its ambitious objective: delivering lifelong replacement therapy to compensate for the deficient production of FVIII or FIX. Over the past 40 years, since the cloning of FVIII and FIX, biopharmaceutical companies have been drawn to hemophilia for reasons clearly articulated by physicians and patients’ advocates. These include the single-gene defect underlying the disease, the straightforward measurement of plasma end points (FVIII and FIX levels in plasma), and the therapeutic potential offered by precisely regulating these clotting factors within a range from low to high concentrations.

Despite advancements in recombinant protein production techniques over recent decades and the increased use of FVIII and FIX concentrates, whether for on-demand treatment, prophylaxis, or to induce tolerance in patients with inhibitors, the market price of these concentrates has remained high in many countries, far exceeding production costs. However, significant commercial cost disparities exist based on the country and health care models, such as tender processes.19 A common observation is that biotechnological innovations have not resulted in a reduction in the cost of hemophilia treatment. Instead, each new therapy option is typically more expensive than its predecessor, often driven by the application of value-based pricing. Interestingly, although the high cost of hemophilia treatments poses a significant barrier to accessibility in most countries, it has also been a key driver of innovation. Over the years, the financial attractiveness of hemophilia treatment has spurred substantial investments in research and development by both established and emerging companies seeking potential financial rewards. Hemophilia A represents a significant market, with annual sales estimated at $10 billion US dollars (USD), whereas hemophilia B accounts for approximately $3 billion USD annually.20 In comparison, other monogenic diseases treated with recombinant therapies generate significantly less revenue. The high revenue historically generated by hemophilia therapies, particularly recombinant FVIII, has created a commercially attractive environment, although the price per unit of recombinant FVIII has dropped substantially over the past 3 decades, from more than $1 USD to as low as $0.06 USD per unit in certain tendering contracts. The sustained market size, coupled with the chronic nature of treatment, has continued to incentivize biopharma companies to invest in innovation, leading to the development of extended half-life (EHL) factors, nonreplacement therapies, and gene therapies, usually at considerably higher prices than $0.06 USD per unit. Hemophilia is frequently cited by industry analysts as a “model” rare disease market, owing to its combination of high unmet medical need, ongoing treatment demand, and longstanding pricing power.

Over the past 40 years, a growing number of pharmaceutical partners have shown interest and invested significantly in hemophilia, including established players such as Pfizer and Novo Nordisk. Some companies, such as Takeda (previously Baxter), Bayer, Octapharma, Swedish Orphan Biovitrum (now Sobi), and LFB (Laboratoire français du fractionnement et des biotechnologies), have been long-term contributors, starting with plasma concentrate production before transitioning to biotechnology-based concentrates and exploring other therapeutic options. Other companies, including uniQure, Roche, Sanofi, and BioMarin, have entered the field more recently, all without previous experience in hemophilia.

Revenues generated by hemophilia treatments have largely benefited shareholders, but some have been reinvested into research and innovation in a competitive environment, fueling progress. Recently, new partners have entered with ambitious goals to develop groundbreaking therapies, such as gene therapy, often mobilizing substantial new investments from investors and shareholders (eg, uniQure, Regeneron, and Be Biopharma). These initiatives have attracted significant capital from venture investors and/or public markets. Investments ranging from $200 million to $500 million USD are common and frequently highlighted in corporate press releases. The cost of launching a new biotechnology venture typically begins at approximately $314 million USD and can exceed $1 billion USD.21,22

Beyond shareholder wealth and innovation, these revenues have supported numerous educational and advocacy initiatives, such as providing aid to health professionals and patient organizations involved in hemophilia at regional, national, and global levels. Programs have included twinning initiatives, donations, discounted concentrates for economically disadvantaged areas, and educational activities. Donations of hemophilia products amount to >300 million units annually, at a retail value of $1 billion USD.23 Meanwhile, the number of patients treated has continued to grow as prophylaxis becomes more widespread among patients with severe hemophilia A or B and those with severe phenotypes, regardless of their FVIII or FIX levels. This includes symptomatic women and girls who carry the hemophilia genes.18,24 These initiatives have raised awareness of hemophilia, enhanced its appeal and established prophylaxis as the global standard or aspirational treatment modality. Reflecting this trend, the global hemophilia market was valued at USD 13.7 billion in 2023 and is projected to grow to USD 24.2 billion by 2032, representing a compound annual growth rate of 6.5% over the forecast period 2024-2032.25

Are investments and reinvestments threatened?

This reinvestment model that has prevailed may be threatened. Several elements could compromise it and deserve our attention (Figure 1).

Failures of some innovations

Although the hemophilia treatment landscape has seen significant advancements, not all innovative therapies have achieved success. For instance, Bayer’s development of befovacimab, an anti–tissue factor pathway inhibitor agent, faced challenges.26 A phase 2 clinical trial was terminated early because of thrombotic events, raising concerns about its safety profile. Similarly, Avigen; Freeline Therapeutics; Baxter/Takeda; Bayer; and, more recently, Pfizer, encountered setbacks and closed their gene therapy programs. Certain new formulations of synthetic FVIII (eg, single-chain design FVIII) and some FIX concentrates have seen limited adoption in a rapidly evolving and competitive market. Centessa Pharmaceuticals has announced the discontinuation of the global clinical development of SerpinPC, a subcutaneously administered inhibitor of activated protein C intended for the treatment of hemophilia B.27 These instances highlight the inherent complexities and risks associated with developing new therapies for hemophilia, as well as for other therapeutic areas. They underscore the critical need for continuous research and innovation to mitigate risks, overcome scientific and regulatory challenges, and address unmet patient needs.

Massive adoption and risk of monopoly

The widespread adoption of a single bispecific antibody that mimics FVIII, emicizumab, currently marketed exclusively by F. Hoffmann-La Roche AG, and its subsidiaries Genentech and Chugai, has significantly reshaped the FVIII market.28 Many pharmaceutical companies involved in recombinant FVIII production have been affected by the dominance of emicizumab, which has become the preferred prophylactic replacement therapy in numerous countries and is frequently favored by both patients and health care professionals. Emicizumab may also significantly reduce, or even eliminate, the need for tolerization treatments in patients with inhibitors, historically high consumers of FVIII, further reducing demand for traditional FVIII therapies.29 This shift threatens the revenue streams that traditional FVIII producers rely on to sustain operations and fund future innovations. It remains uncertain how many standard and EHL FVIII products will endure in this transformed market. Most recently, Takeda announced they would discontinue production of a plasma-derived FVIII and their first-generation recombinant FVIII. The reinvestment of emicizumab-generated revenues in hemophilia research and development will become clearer in time. Likely, a more competitive landscape will emerge, featuring additional bispecific antibodies that mimic FVIII, such as Mim8 (denecimig) from Novo Nordisk; NXT007 from Roche; as well as the UL or high-sustained activity FVIII concentrate, efanesoctocog alfa, from Sobi and Sanofi,8 which are expected to become increasingly accessible.

Technological lock-in

A significant number of patients and health care professionals seem very satisfied with recent developments, both in terms of efficacy and burden. Some show little interest in newer innovations.30 This situation is not without potential negative consequences. Ideally, the entire community should aspire to treatments that cure hemophilia, making protein therapies obsolete, an ambition distant from most currently available innovative treatments and even more distant for most of the world. Although some individuals with hemophilia A and B have achieved factor levels within the normal range, considered curative, through gene therapy, this outcome is not universal. For hemophilia B, factor expression may remain stable for many years, whereas for hemophilia A, initial FVIII levels often start below normal and tend to decline over time.31,32 The current therapeutic revolution in hemophilia is extraordinary, but continued innovation remains essential. In this regard, recent publications have reported promising phase 1 of 2 clinical trial results using a lentiviral vector to deliver FVIII to hematopoietic stem cells ex vivo. This approach has demonstrated double-digit FVIII production, presenting a novel path toward a potential cure for hemophilia A by integrating the FVIII transgene into the chromosomes.33 Two early stage studies using CRISPR-CRISPR–associated protein 9–directed gene editing to permanently place the FIX transgene into a safe harbor locus in patients, are just initiating; long-term risks of gene editing are not yet understood.

Uncertain future of rebalancing therapies

Several so-called nonsubstitutive rebalancing therapies have been recently validated and registered in several countries (concizumab from Novo Nordisk, marstacimab from Pfizer, fitusiran from Sanofi).7,34-36 They are promising products for some patients but raise concerns, particularly regarding the thrombotic risk and overall balance between risk and benefit.37 It is currently difficult to know what the success of these treatments will be and whether the investments made will be compensated by sufficient adoption in a competitive environment.16 They may provide favorable benefit/risk profiles to patients in specific countries without other highly efficacious advanced therapies.

Reluctance and delay in the adoption of gene therapy

Despite the approval and reimbursement of 1 gene therapy product for hemophilia B and another for hemophilia A in several countries, uptake has been remarkably slow. In February 2025, Pfizer announced the global termination of its hemophilia B gene therapy, fidanacogene elaparvovec, citing limited interest from both patients and clinicians. Notably, no patients had received the treatment in a commercial setting. In parallel, the company halted development of its FVIII gene therapy after completing a phase 3 licensure trial, choosing not to proceed with a regulatory submission to the US Food and Drug Administration. Although no formal rationale was provided, the study revealed that approximately half of the participants experienced transient, marked elevations in FVIII levels necessitating anticoagulation therapy, and 1 patient developed an inhibitor to FVIII. The hesitancy observed among patients and health care providers may be attributed to multiple factors: high costs, logistical and procedural complexities, safety and efficacy concerns, and the significant paradigm shift inherent to gene therapy.38 This cautious approach, despite the promise of gene therapy, particularly in hemophilia B, carries potential consequences, including the risk of discouraging further innovation and investment. This issue is especially salient given that several companies investing heavily in gene therapy are not the traditional market leaders in conventional hemophilia treatments. With substantial private capital already committed, investor confidence is being tested by the limited number of patients currently accessing these groundbreaking therapies.

Insufficient endorsement of therapeutic innovation

The recent publication and dissemination by International Society on Thrombosis and Haemostasis of guidelines comparing innovative and older therapeutic options solely based on very few controlled and randomized clinical trials in hemophilia and concluding no differences in efficacy could have a very negative impact.39 Indeed, such guidelines conclude that there are not enough solid scientific arguments in favor of the superiority of innovative agents over classical therapeutic approaches. This may have a very adverse impact on access to treatments, their reimbursement, future investments, and the attractiveness of hemophilia.40 Beyond controlled randomized clinical trials, which are rarely feasible in hemophilia, data from registries, real-world studies, expert opinions, and patient outcome assessments should be considered when establishing best practice recommendations in the interest of patients.41 Taken together, the data on newer therapies such as EHL-FVIII/FIX and UL-FVIII, plus bispecific antibodies set a new bar for goals of 0 bleeds, higher trough levels (or no troughs), and directional movement toward a hemophilia-free mind.42 All these recent studies and their improved outcomes were not recognized by these International Society on Thrombosis and Haemostasis guidelines that only assessed randomized controlled trials.

The need for new ambitions and outcomes

Beyond universal prophylaxis and bleeding control, the main goal of hemophilia treatment is to enable patients to lead as normal a life as possible, both physically and mentally. It is also essential to minimize the impact of their condition and its management on their loved ones (family, friends, and colleagues). Today, comparing treatments solely based on bleeding control is no longer meaningful. A comprehensive and holistic approach is essential. This aspect is crucial to encourage and stimulate innovation and make it attractive. The cost of bleeding control should progressively be replaced with the costs as well as benefits of a more normalized hemostasis phenotype.43 This is an ambitious goal that will require developing tools to assess and measure this normalization.

The imperative need to reduce treatment costs

In most developed countries that fund access to hemophilia treatments, the budget allocated has increased over recent decades. This can be attributed to the growing adoption of prophylaxis, an increasing number of patients, greater use of immune tolerance therapies, surgical procedures, and the higher costs of innovative treatments (such as EHL concentrates and bispecific antibodies). It is highly unlikely that these budgets will continue to grow at the same pace. Therefore, it is imperative to maximize the value of existing budgets and ensure they allow a growing number of patients access to the most innovative treatments.44

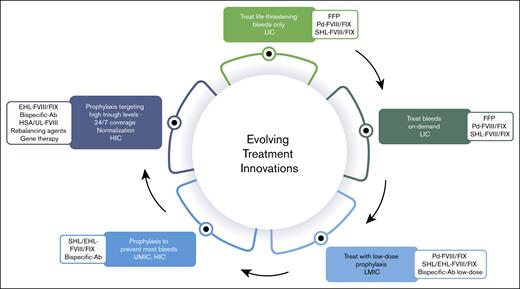

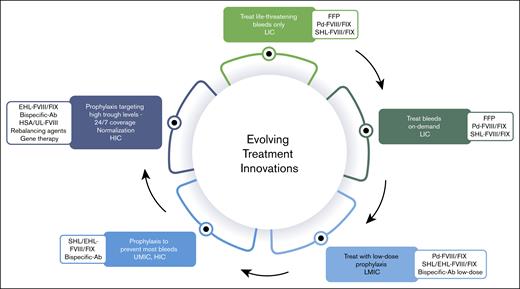

In addition, given the multiple therapeutic innovations, particularly nonsubstitutive therapies, there is no justification for using the cost of FVIII and FIX replacement therapies as a benchmark. Although ensuring a return on investment and maintaining an attractive market is reasonable, it is equally essential to consider the growing number of patients and the financial constraints that affect access to treatment. Producers of hemophilia therapies primarily focus on the 15% of patients in high-income countries, dedicate some attention to the next 15% in upper-middle-income countries, and largely overlook those in lower-middle-income and low-income countries.15 These underserved populations, who also live with hemophilia, experience significantly higher morbidity and mortality because of limited or nonexistent access to therapies.23 However, patients in these regions could still receive treatment, and companies could achieve sustainable profits if pricing strategies were better aligned with the economic realities of each country. In other words, sales volume could offset lower prices, a concept that the pharmaceutical industry has yet to widely implement (Figure 2).

Income status, health (in)equity, (lack of) access to treatment modalities and therapeutic innovations for persons with hemophilia. Ab, antibody; FFP, fresh frozen plasma; HSA, high-sustained activity; HIC, high-income country; LIC, low-income country; LMIC, low-middle-income country; Pd, plasma-derived; SHL, standard half-life; UMIC, upper-middle-income country.

Income status, health (in)equity, (lack of) access to treatment modalities and therapeutic innovations for persons with hemophilia. Ab, antibody; FFP, fresh frozen plasma; HSA, high-sustained activity; HIC, high-income country; LIC, low-income country; LMIC, low-middle-income country; Pd, plasma-derived; SHL, standard half-life; UMIC, upper-middle-income country.

Rare bleeding disorders

Although the primary focus is on hemophilia A and B, it is important to acknowledge patients with rare bleeding disorders.45,46 Historically, these conditions have been largely overlooked by technological advancements because of the lack of a viable return on investment for drug developers. However, this landscape is beginning to change, with ongoing clinical trials investigating new therapies for von Willebrand disease, Glanzmann thrombasthenia, and FX deficiency.47-49 These are welcome developments that could significantly improve treatment options for affected patients. Additionally, preclinical research into gene therapy for von Willebrand disease is progressing, offering hope for long-term solutions.50,51 Improved dialogue and collaboration with regulatory agencies could further accelerate innovation. For example, adapting the FIX transgene cassette for other vitamin K–dependent factors, such as FVII and FX, by substituting transgenes into the adeno-associated virus cassette, could provide curative therapies for these rare bleeding disorders. This approach could bypass the need for a full-scale development program costing hundreds of millions of dollars, making it a more cost-effective strategy for addressing these unmet medical needs. Dialogue with regulators is essential to find a path forward.

The crucial role of public investment in hemophilia treatment innovation

Innovation in hemophilia therapy has been fueled by a synergistic interplay between public and private funding. Although pharmaceutical and venture capital investment has been critical in advancing therapeutic candidates through clinical development and commercialization, public financial support, particularly through agencies such as the US National Institutes of Health (NIH), has laid the foundational groundwork for these breakthroughs. The NIH and its funded academic institutions have contributed to the research underpinning 354 of 356 drugs approved by the US Food and Drug Administration between 2010 and 2019.52

In the field of gene therapy, the NIH, often in collaboration with the European Union, has played an outsized role over the past 4 decades, consistently supporting the basic science that allowed the field to overcome numerous scientific and technical challenges. The transition from gene therapy to gene editing, now a transformative area of medicine, was made possible largely through research conducted at US universities, almost entirely funded by public agencies.53

However, recent substantial funding cuts to the NIH and other US government research programs, as well as the withholding of grant funds from several leading academic institutions, pose a significant threat to the pipeline of innovation. The full ramifications of these reductions may only become apparent over the coming years, but early indications suggest a profound chilling effect on global therapeutic advancement. Basic science, by its nature, requires long-term investment without immediate commercial return. Undermining this foundational pillar risks stalling not only future hemophilia therapies but broader biomedical progress.54

Expanding access and revenue: turning low-income countries into viable markets

Currently, only 15% to 20% of the global hemophilia population has access to state-of-the-art therapies. This leaves the remaining 80% to 85% relying on either no treatment at all or on older, plasma-derived or conventional products, most often used for on-demand treatment rather than prophylaxis. Consequently, any increase in product supply to these underserved populations represents potential for incremental revenue growth. Given that the number of individuals without adequate access is ∼5 times that of those with access, the opportunity for product sales at significantly lower prices becomes apparent. Leveraging volume-based strategies, a well-established commercial approach, could therefore help expand reach and impact. Older therapies, such as plasma-derived or conventional recombinant clotting factor concentrates, have already found their way into lower-income countries at minimal cost, often facilitated by government tenders.

But what of newer therapies withdrawn from high-income markets, not because of safety concerns but because of poor market uptake or inability to compete with newer alternatives? Could redirecting such therapies to the developing world offer a pathway for their continued use? This question is particularly relevant in the case of hemophilia gene therapies, many of which are being discontinued despite years of investment. Although these products may not be competitive in saturated markets, they could still hold substantial value in settings in which therapeutic options are limited and the benefit-risk profile may be viewed more favorably. Redirecting these therapies to low-income countries, however, cannot be done without thorough ethical consideration and robust safeguards. Infrastructure must be in place to ensure safe administration, long-term monitoring, and follow-up. If implemented responsibly, this approach could not only extend the lifecycle of therapies but also address a significant global treatment gap, benefiting both patients and the sustainability of innovation.

Conclusions and perspectives

The high cost of hemophilia treatment, driven by the value-based pricing of innovative therapies, continues to attract new biopharma companies seeking to apply their unique technologies to address the underlying causes of hemophilia. However, despite major biotechnological advancements and increased production efficiencies, the cost of newer treatment options remains very high. This market-driven reality has faced criticism and, in some cases, rejection by health technology organizations, even when a country’s regulatory agency has approved the therapy.

That said, we acknowledge that high treatment costs support and encourage cycles of investment in increasingly innovative therapies, leading to improved hemophilia management and better patient outcomes. Nevertheless, a better balance is needed between access and pricing.

Based on these considerations, it is crucial to preserve and promote this positive cycle. The significant financial resources allocated to hemophilia treatment within health care budgets should not only compensate shareholders and maintain an attractive investment environment but also encourage future innovations. At the same time, these efforts should extend to the global community through modest yet meaningful altruistic initiatives supported by pharmaceutical partners.

Furthermore, ensuring that the cost of treatment per patient decreases is essential to expanding access to prophylaxis for a larger number of patients worldwide. Striking a balance between health care budgets, patient costs, production and marketing expenses, and development investments is critical, all while maintaining the sector’s appeal for continued investment and innovation.

Although not the primary focus of this paper, the rapid evolution and adoption of digital technologies and artificial intelligence are likely to have a profound impact on the future of hemophilia care. These tools can accelerate innovation, inform treatment decisions, and help integrate novel therapies more efficiently into clinical practice, ultimately shaping the next generation of therapeutic investment.

Preserving and promoting this reinvestment cycle is fundamental to achieving the future ambition of hemophilia treatment, namely, physical and mental normalization and a “hemophilia-free mind” for all patients globally.

Authorship

Contribution: C.H. initiated this project; and all authors contributed to the writing of the manuscript and approved the final version of the manuscript.

Conflict-of-interest disclosure: C.H. has received consulting fees from Sobi, CAF-DCF (Centrale Afdeling voor Fractionering - Departement Central de Fractionnement), CSL Behring, F. Hoffmann-La Roche, LFB (Laboratoire français du fractionnement et des biotechnologies), Novo Nordisk, Octapharma, Pfizer, Shire/Takeda, BioMarin, and Regeneron. G.F.P. has been a paid consultant for BioMarin, Novo Nordisk, Pfizer, Regeneron, Genentech/Roche, and Sanofi; and served on scientific advisory boards for Be Biopharma, Frontera, ITC Bio, Metagenomi, the US National Bleeding Disorders Foundation Medical and Scientific Advisory Council, the International Society on Thrombosis and Haemostasis Gene Therapy Working Group, and the World Federation of Hemophilia board of directors.

Correspondence: Cedric Hermans, Hemostasis and Thrombosis Unit, Division of Adult Hematology, Cliniques universitaires Saint-Luc, Université catholique de Louvain, Ave Hippocrate, 1200 Brussels, Belgium; email: cedric.hermans@uclouvain.be.