Introduction: With many standard half-life (SHL) and extended half-life (EHL) recombinant factor VIII and factor IX products licensed in the US over the last 6 years, it is likely that previously treated patients (PTPs) will consider switching to a new EHL FVIII or FIX product. Although past product switching surveillance suggests no increased inhibitor development risk, there is the need for a real-world data on the incidence of inhibitor development following switching from SHL to EHL rFVIII or rFIX in PTPs with hemophilia A and B.

Methods: A longitudinal, observational study of participants with Hemophilia A or B who switched to a rFVIII or rFIX concentrate licensed after Jan 1, 2013. The study included retrospective (switched within 50 exposure days (EDs) and prospective arms. Participants were recruited from ATHN-affiliated Hemophilia Treatment Centers (HTCs). The primary outcome measure was the development of a new inhibitor (i.e. neutralizing antibodies to factor VIII or IX) a 1 year or during the 50 EDs following the product switch. Plasma samples were collected at baseline, 10 EDs and 50 EDs. Inclusion criteria include moderate or severe hemophilia A/B currently on a plasma-derived or recombinant FVIII or FIX concentrate with planned or recent switch to an EHL FVIII or FIX concentrate approved after Jan 1, 2013. Participants with an active inhibitor at time of enrollment or undergoing ITI or switched to a non-factor product were excluded.

Results: 303 hemophilia participants from 27 treatment centers were enrolled from 2015 to June 2019. The median age at enrollment was 17 years (IQR 10-32 years). 300 of 303 participants were male, Caucasian (72.6%) and had private insurance (44.9%). 74.3% were FVIII deficient and 25.7% were FIX deficient. Most had severe hemophilia A or B, 82.3% (n=237) and 12.8% (n=37) had a prior history of inhibitor but were negative at the time of enrollment. Prior to the switching, 92.1% (n=197) and 7.9% (n=17) of hemophilia A participants took standard rFVIII or pdFVIII respectively, while 87.8% (n=65) and 12.2% (n=9) of hemophilia B participants took standard rFIX or pdFIX, respectively. The three most frequent switching reasons were extended half-life consideration (n=192; 66.7%), a desire for a longer acting version (n=55; 19.1%) and less than expected clinical response to the current product (n=15; 5.2%).

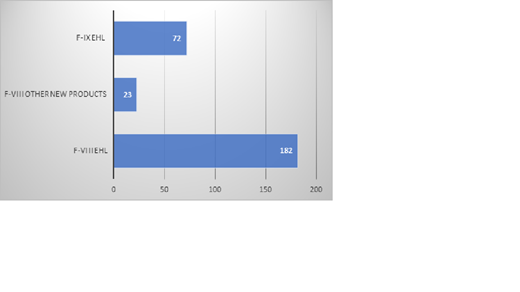

Among 214 participants with hemophilia A, 182 (85.0%) switched to FVIII EHL products while 23 (10.7%) switched to new SHL FVIII. For nine patients (4.2%) switching product information was not available. 72 out of 74 (97.3%) participants with hemophilia B that switched products, switched to an EHL rFIX. Eleven hemophilia participants (six A and five B) entered a second cycle of switching after the completion of the first switching cycle. Following that, four switched to FVIII EHL products, two to new SHL rFVIII and five to rFIX EHL products. A total of 193 (63.7%; 148 FVIII, 45 FIX) participants completed the clinical trial while 36 (11.9%; 26 FVIII, 10 FIX) did not complete the trial and 74 (24.4%) are ongoing in the trial.

None of 303 (0%) enrolled participants developed an inhibitor, the primary outcome for this study, through data updated 6/2019. Variability was noted in per-site enrollment. The median enrollment per Hemophilia Treatment Center (HTC) was 10, the IQR was 7-16 with a range of 1-31. The types of factors associated with patients switches are summarized in the figure.

Conclusion: No new inhibitors were noted among 303 moderate/severe hemophilia A/B PTPs without active inhibitors at entry, who switched factor VIII or IX products over 50 exposure days or 12 months. This result provides real-world evidence of the rarity of inhibitor development after a product switch in PTPs. The study also achieved a key logistical objective: to demonstrate feasibility of a prospective observational study across ATHN sites.

Figure Legend: Factor types to which ATHN-2 patients switched during the study.

Sidonio:Grifols: Membership on an entity's Board of Directors or advisory committees, Research Funding; Uniqure: Membership on an entity's Board of Directors or advisory committees; Kedrion: Research Funding; Takeda-Shire: Membership on an entity's Board of Directors or advisory committees, Research Funding; Bioverativ: Membership on an entity's Board of Directors or advisory committees, Research Funding; Octapharma: Membership on an entity's Board of Directors or advisory committees, Research Funding; Biomarin: Membership on an entity's Board of Directors or advisory committees; Novo Nordisk: Membership on an entity's Board of Directors or advisory committees; Genetech: Membership on an entity's Board of Directors or advisory committees, Research Funding. Guelcher:Takeda: Other: Advisory Board; Genetech: Other: Advisory Board; NovoNordisk: Other: Advisory Board; Octapharma: Other: Advisory Board. Takemoto:genentech: Membership on an entity's Board of Directors or advisory committees; novartis: Other: DSMB membership. Tarantino:Novo Nordisk: Consultancy, Honoraria, Research Funding, Speakers Bureau; Takeda: Consultancy, Honoraria, Membership on an entity's Board of Directors or advisory committees, Research Funding, Speakers Bureau; Michael Tarantino, MD SC: Other: President, Owner- Private Practice ; Magellan Healthcare: Consultancy; Amgen: Consultancy, Honoraria, Membership on an entity's Board of Directors or advisory committees, Other: Clinical Trial PI, Speakers Bureau; Roche: Consultancy; Grifols: Consultancy, Honoraria, Membership on an entity's Board of Directors or advisory committees, Speakers Bureau; Bleeding and Clotting Disorders Institute: Employment; Genentech: Consultancy, Honoraria, Membership on an entity's Board of Directors or advisory committees; Pfizer: Consultancy, Honoraria, Other: Grant Reviewer , Research Funding; Octapharma: Consultancy, Speakers Bureau. Neufeld:Octapharma, Agios, Acceleron, Grifols, Pfizer, CSL Behring, Shire Pharmaceuticals (Baxalta), Novo Nordisk, ApoPharma, Genentech, Novartis, Bayer Healthcare: Consultancy; Octapharma, Shire Pharmaceuticals (Baxalta), Novo Nordisk, Celgene, NHLBI/NIH: Research Funding; Octapharma: Other: study investigator, NuProtect study (Octapharma-sponsored).

Author notes

Asterisk with author names denotes non-ASH members.