Note: Dr. Dykes formerly served as 2024-2025 chair of the ASH Trainee Council.

The median four-year, in-state cost of attendance for the class of 2025 medical school graduates was $286,454 at public institutions and $390,848 at private institutions.1 Unfortunately, while the cost of training hematologists is high and rising, student loan policy has become a political target, with major changes included in the recently signed version of the Big Beautiful Bill and ongoing efforts by the Trump administration to overhaul the Public Service Loan Forgiveness (PSLF) program.2,3

Rapid and unpredictable changes to student loan policy force aspiring future hematologists reliant on student loans to make difficult financial decisions that could significantly affect major aspects of their adult life based on a volatile and shifting financial aid landscape. Most of the recent changes negatively affect student borrowers, jeopardizing the future hematology trainee pipeline dependent on government aid and PSLF to finance their medical training.

Since the 1980s, the cost of medical school has increased more than 80%, with the debt levels of medical trainees rising more than 150%.4 In 2024, 71% of medical school graduates reported educational debt, with a median amount of $205,000 according to the Association of American Medical Colleges.1 Of those indebted medical school graduates, 56% owed $200,000 or more and 23% owed $300,000 or more.1 Today, most medical school debt is financed by students through a series of federal loans; meanwhile, personal and familial contributions have diminished, with rising costs having outpaced these resources.4 Incurred debt has serious ramifications, particularly if not paired with sufficient financial education, including higher rates of stress and burnout, as well as the potential for long-lasting psychological effects.5,6

Since 2007, PSLF has provided relief for graduates by offering federal loan forgiveness in exchange for 10 years of income-adjusted payments while working full-time for a qualified organization.7 While not initially designed for medical school graduates (and notoriously difficult to navigate), the PSLF program has been increasingly relied upon by physicians who incur significant loan burdens due to training costs.8 As of 2024, 63% of graduating medical students were planning to enter a loan forgiveness or repayment program.1 At the resident level, at least 20% report that PSLF influenced their career choices, including longer training pathways, less lucrative specialty selection, or a career in academic medicine.5

Over the past several months, there have been unprecedented changes to student loan borrowing policy, income-driven repayment options, and the PSLF program, creating turmoil for both current and future borrowers. Since July 2024, there has been an ongoing court injunction halting the novel Biden administration Saving on a Valuable Education (SAVE) plan with forced administrative forbearance for nearly 8 million bystanding borrowers, preventing progress toward PSLF.8 Cuts and changes within the U.S. Department of Education have led to administrative delays and inadequate interface with borrowers.9 On July 4, 2025, the Big Beautiful Bill was signed into effect after several versions circulated the House and the Senate — including one that attempted to eliminate PSLF eligibility for medical residents.2,3 The final version of the bill includes policy with the potential to harm current and future medical student loan borrowers. Key changes include:

Limited federal student loan options with borrowing caps for professional students and Parent PLUS loans, potentially forcing increased private loan borrowing.2,3

Creation of a new Repayment Assistance Plan (RAP) that eliminates $0 payment options for low-income earners, dramatically limits forbearance options for financial hardship, and requires higher payments with a longer repayment period of 30 years. RAP calculates monthly payments on adjusted gross income (AGI), including spousal income, taking a percentage of every dollar earned, with an increased percentage garnished with increased income (up to 10% AGI).2,3

Phasing out the most current (and more favorable) income-driven repayment plans by June 2026, forcing current borrowers onto either older, more expensive income-driven repayment plans or the new RAP.2,3

Thankfully, PSLF is still an option for those on RAP and older repayment plans.3 However, efforts are separately underway to target PSLF outside of the Big Beautiful Bill, attempting to restrict PSLF for employees of nonprofit organizations with policies and missions that conflict with the administration’s ideology.

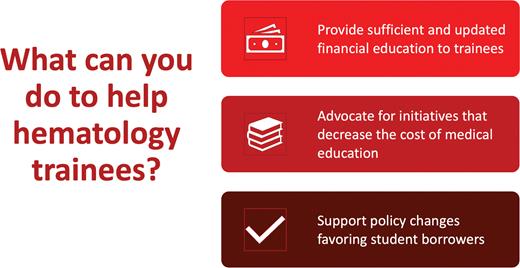

Changes to student loan policy and the instability of the PSLF program in the face of exorbitant costs associated with medical education are potentially harming those with current outstanding loans, as well as deterring future trainees. You can help address the growing threat to the hematology trainee pipeline by providing critical mentorship10 and advocacy support.

Disclosure Statement

Dr. Dykes has federal student loans that are currently in administrative forbearance due to SAVE litigation. Drs. Zhang and Park indicated no relevant conflicts of interest.