Abstract

Effective drug therapies are a cornerstone of medical practice. The path from drug discovery to approval is expensive and commonly associated with failure. The cost of drug development exceeds 800 million dollars per product. Late failure due to lack of clinical efficacy is a common cause of high costs. Recent attempts to improve the process of drug development involve the formation of public–private partnerships, which are facilitating the creation of new collaborations among corporate and nonprofit entities to find solutions that will accelerate innovative drug discovery.

Introduction

It is not possible for us to practice medicine without a prescription pad. Drugs contribute importantly to patient outcomes and it is fair to say that their appropriate use can help reduce overall healthcare expenditure. Drugs are a constant topic in the health care cost debate, probably because of their direct impact on the consumer (through copays and other out-of-pocket charges) and their obvious association with a highly visible, for-profit industry. In 2011, prescription drug costs in the United States were only 10% of the 2.7 trillion dollar health care budget, but an annual outlay of 263 billion dollars is not to be ignored.1

Many approved drugs have significantly advanced the care of individuals with serious disease for whom prior options were often minimally effective or nonexistent. Good examples that hematologists are familiar with include rituximab (Rituxan) for lymphoproliferative malignancies and autoimmune disease, imiglucerase/alglucerase (Cerezyme/Ceridase) for Gaucher's disease, eculizumab (Solaris) for paroxysmal nocturnal hemaglobinuria, imatinib mesylate (Gleevec) for chronic myleogenous leukemia, bortezomib (Velcade) for multiple myeloma, and recombinant factors 8 and 9 for hemophilia. However, the path from initial idea to Food and Drug Administration (FDA) approval for these and many other drugs is always long, tortuous, and fraught with failure and waste. The drug industry's innovative performance has not kept pace during the most recent period of rapidly advancing scientific knowledge, prompting the common assertion that the drug discovery and development process is broken or badly flawed.2

Problem statement

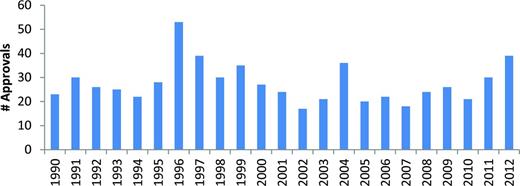

Frequently quoted data from the Tufts Center for the Study of Drug Development indicate that the total capitalized cost for developing a new drug is more than 800 million dollars and that the average development time can be as long as 10 years.3-5 Reexamination of these cost estimates suggests that the current figure may be closer to 990 million dollars.4 The magnitude of the productivity problem is further revealed by a review of the cumulative pharmaceutical industry/biotechnology research and development (R&D) scorecard. Between 2005 and 2010, the 500 largest companies spent a total of 688 billion dollars on R&D and the FDA approved 131 new drugs.6 Save for a transient burst of approvals in the mid-1990s, probably associated with FDA compliance with the Prescription Drug Users Fee Act legislation, the annual approval rate of new drugs has not changed dramatically over the past 25 years (Figure 1).5

FDA drug approvals 1990-2012. Figure courtesy of the Center for Drug Evaluation and Research, FDA.

FDA drug approvals 1990-2012. Figure courtesy of the Center for Drug Evaluation and Research, FDA.

Recently, the pharmaceutical industry has had to react to a triple threat: significant revenue declines resulting from the loss of patent protection for high-value products, the rising cost of R&D, and an inadequate number of new product approvals to drive growth. Between 2011 and 2016, more than 267 billion dollars in sales are at risk due to patent expirations. In 2013 alone, the industry will see 40 brand name drugs lose patent protection and affect 33 billion dollars in annual sales.6 A recent example is Pfizer's loss of atorvastatin (Lipitor) to the generic market. Over its patent life, Lipitor generated over 100 billion dollars in sales.7 Pfizer's plan was to replace Lipitor with torcetrapib, a cholesteryl-ester-transfer-protein inhibitor, but that product failed in phase 3 due to toxicity issues8 and no replacement was found.

If, on average, drugs have an 8- to 10-year development cycle and little more than an 8% to 24% success rate, it is easy to understand why companies are not able to innovate their way back to revenue growth.9,10 Instead, they often turn to merger and/or acquisition to fill pipeline gaps. Because this activity requires significant upfront expense, costs are often offset by reductions in research spending, the underlying thinking being that near-term profit reductions can only be resolved by access to late-stage products and not by improvements in target identification and drug development.

In the midst of this advancing malaise, a grand scheme emerged. Biotechnology-focused venture investors with money to spend and a healthy appetite for risk tapped into an apparent gold mine of new ideas. They created numerous biotechnology companies that were often built upon concepts originating in academic laboratories in the United States and around the world. Over the past 30 or 40 years, venture investing in biotechnology start-ups has been a critical pathway enabling new ideas to gain access to necessary funding.11 Companies such as Biogen, Idec, Amgen, Gennentech, Genzyme, Gilead, Celgene, Millenium, Ariad, and Alexion and many others are successful graduates of this process. Many of these entities were acquired by big pharmaceutical companies looking to fill pipeline gaps or to access new discovery platforms. Others kept coming to fill the void—until now.

Currently, venture funding of new biotechnology startups is declining. Equity investments in US venture–backed life science companies totaled 6.2 billion dollars in 2012, a 19% decrease in dollars and a 12% decrease in deals compared with 2011. It is estimated that life science–focused venture funds raised only 2.5 billion in new dollars during 2012. Fundraising by life science venture capitalists has been declining since 2009 and is now likely below the level needed to sustain the current level of investment.12 The number of new companies being formed will decline and continued funding of existing companies will be reduced. These reductions are not occurring because of lack of worthy ideas, but rather due to investors reacting to the long timelines and high cost of drug development. Venture capital is increasingly favoring sectors and business models that require less technology and development risk. Examples include digital health and healthcare information technology companies and drug development companies that can access clinical-stage assets.

Identifying root causes

Are there identifiable causes at the core of the “innovation stagnation” and can they be fixed? A Congressional Budget Office study of the pharmaceutical industry identified six important drivers of increasing R&D costs that affect innovative drug discovery13 :

An increase in the percentage of drug projects that fail in clinical trials;

A trend toward bigger and lengthier clinical trials and a possible rise in the number of trials that firms are conducting;

A shift in the types of drugs that companies work on toward those intended to treat chronic and degenerative diseases;

Advances in research technology and in the scientific opportunities facing the pharmaceutical industry;

The increased commercialization of basic research as firms more often pay for access to basic research findings that in earlier years might have been freely available; and

A lengthening of the average time that drugs spend in preclinical research.

This list indicates that the critical drivers of R&D cost are overall failure rate and elapsed time before failure. The occurrence of failure late in clinical development suggests a problem in the information regime that guides drug discovery. Compare the building of a new jet liner (even the Boeing 787 with its completion delays and lithium battery problem) to the discovery and development of a novel anticancer agent. For the new plane, once the project is initiated and plans drawn up, the likelihood of failure falls dramatically. This development process is characterized by an information-rich knowledge regime; risk is rapidly reduced during early activities. The opposite applies to a novel cancer drug candidate. If it fails, it is likely to be because of lack of efficacy discovered after completion of large, expensive, and time-consuming phase 2 or phase 3 studies.

Much of drug development is characterized by a knowledge-poor information regime. It cannot be determined if a drug candidate will succeed or fail until very late in the development timeline. Central to this problem is the limited value of animal models. Preclinical studies for target identification and validation, in vitro activity characterization, and in vivo efficacy in model systems have limited value when it comes to de-risking novel drug candidates, and therefore much of the 800 million dollars spent on a new drug is lost to failure.14

In addressing the question of why drug discovery is so difficult, Stewart Lyman, an observer of the pharmaceutical and biotechnology ecosystem, remarked “the answer is actually pretty straightforward: because biology is amazingly complex. It's not rocket science: it's much harder.”15 Has the pharmaceutical industry harvested all of the low-hanging fruit? Will drug discovery grind to a halt awaiting a new paradigm that enables our understanding of pathobiologies that currently elude explanation?

From an historic perspective, the lack of fundamental disease understanding has not prevented the discovery of important drugs; highly effective anticancer treatments such as alkylating agents, anthracyclines, and vinca alkaloids were developed without a comprehensive understanding of cancer pathobiology. However, current costs and timelines can no longer allow the inefficiencies inherent in such a random walk. Discovery must be guided by much improved disease understanding.

The reductionist view of biology suggests that by understanding the parts, the whole can be explained. There is no doubt that this approach has mapped many basic pathways. However, biologic systems manifest emergent behaviors and properties that cannot be predicted on the basis of simply identifying the parts.16 For example, bacteria and cancer cells have redundant pathways that can adapt under the stresses that occur during chemotherapy, resulting in treatment failure.

Much of current drug discovery is predicated upon finding a “magic bullet” directed against a single receptor and/or pathway, a heavy influence of the reductionist view.17 Many have been tried and few have succeeded. This mindset persists despite overwhelming clinical evidence that the best therapeutic outcomes commonly require complex multidrug protocols. Cancer, AIDS, and type 2 diabetes are good examples. We are reductionists in the laboratory but practice complexity in the clinic.

Recent thinking suggests that, rather than eschew complexity, we should embrace it as a fundamental characteristic of biologic systems and a key to advancing drug discovery. The National Institute of General Medical Sciences (NIGMS) has “sought to explore the integration between systems biology and pharmacology, believing that systems approaches are needed to understand the complexity of drug action.”18 NIGMS efforts resulted in a white paper that encourages the learning and application of quantitative and systems pharmacology in drug discovery. To operationalize these ideas, the NIGMS has created the National Centers for Systems Biology (http://www.systemscenters.org). Currently, 15 centers are funded and work across a broad array of projects that address basic cellular and molecular biological processes.

An example of these ideas in action is the Initiative in Systems Pharmacology at Harvard Medical School, directed by Marc Kirschner. Although not primarily a drug discovery platform, the program will focus on developing a comprehensive understanding of complex systems and how drugs interact with them. Kirschner recognizes that academia does not have a complete drug discovery tool kit but that “Science in general has gained a lot from being forced to think about practical problems… We might learn something here that will help the drug pipeline.”19

Solutions through collaboration

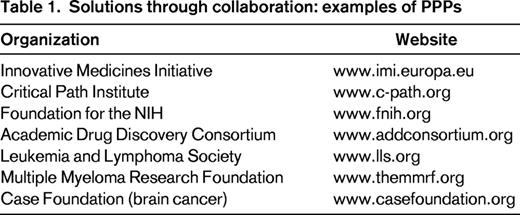

At a more applied level, several broad-based programs intended to improve the process of drug discovery have recently been initiated in both the United States and Europe. Among the most interesting are various public–private partnerships (PPPs). PPPs are intended to catalyze significant interaction between pharmaceutical and biotechnology companies, academic institutions, science and regulatory agencies, patient advocacy groups, and occasionally other entities interested in healthcare advances. The research agenda of a typical PPP is directed at topics of common interest to all parties, usually precompetitive issues that avoid intellectual property concerns. PPPs provide opportunities for interested clinicians and academic investigators to participate in evolving strategies to improve drug discovery and even advance candidate molecules (Table 1).

Recognizing that “Europe has been losing its leadership position in terms of biopharmaceutical R&D to the US” and that “the decline of biopharmaceutical R&D undermines business confidence in Europe and thus Europe's competitiveness in the sector,” the European Commission, the European Federation of Pharmaceutical Industries and Associations (EFPIA), and other stakeholders created the Innovative Medicines Initiative (IMI).

The IMI is a PPP established to improve the process of discovery and development of innovative medicines and thereby reinvigorate the biopharmaceutical industry in Europe. The IMI is guided by a strategic research agenda that is reviewed and updated over time. Overarching priorities are to improve prediction of safety and efficacy and to bridge knowledge management gaps.22

The European Union launched the IMI in 2008 and provided it with 2 billion Euros of funding. Consortia of corporate and nonprofit entities apply for funding to conduct IMI-sponsored projects.

Key research areas include:

New taxonomy of human diseases and pharmacogenetics;

Rare diseases and stratified therapies;

Systems approaches to drug research;

Beyond high throughput screening—pharmacological interactions at the molecular level;

Active pharmaceutical formulations;

Advanced formulations;

Stem cells for drug development and toxicity screening; and

Integration of imaging techniques into drug research.

Two examples of existing consortia are: the IMI One project, which has assembled a 10 000-patient database on schizophrenia that includes genetic and imaging data, and the European Lead Factory. Because most drugs are small molecules, their discovery and development require sophisticated library screening and medicinal chemistry support. These capabilities are not commonly available to academic investigators. The European Lead Factory will be a collection of a half million compounds (sourced from public and private collections) placed in a high-throughput screening center. The facility will offer researchers in academia the opportunity to have their targets screened against its library to identify “hits” and will then provide support that will enable a hit to be matured to a product candidate. These product candidates may become drugs and/or tools to validate disease targets.

In the United States, there are also PPPs focused on creating collaboration across the same groups addressed by the IMI. In 2004, the FDA launched that Critical Path Initiative (CPI), “critical path” referring to key steps in drug development. CPI enunciates the FDA's strategy for “transforming the way FDA-regulated products are developed, evaluated, and manufactured.”23 Agenda items of particular interest to the academic community include:

Developing better evaluation tools such as biomarkers and new assays;

Streamlining clinical trials by modernizing the clinical trial sciences to make trials safer and more efficient;

Developing products to address urgent public health needs; and

Focusing on at-risk populations such as pediatrics.

Funding to the scientific community to help address some of these issues is provided by direct grants from the FDA and through a nonprofit foundation, the CPI. Like the IMI, but on a smaller scale, the CPI seeks to develop multiconstituency consortia to address identified problems in drug development.24

The Nation Institutes of Health Public-Private Partnership program was initiated to facilitate a wide range of interactions between nongovernmental organizations (the same broad groups that the IMI and CPI engage). The program is directed through the Foundation for the National Institutes of Health. One of the most advanced of the resulting programs is the Biomarker Consortium (BC).25

The primary BC focus areas are cancer, immunity, and inflammation;metabolic disorders; and neuroscience. Within these target areas, projects are funded that will:

Facilitate the development and qualification of biomarkers;

Qualify biomarkers for diagnosing disease and predicting clinical response;

Translate results to aid regulatory decision-making; and

Ensure that project results are widely available to the scientific community.

The BC has established a simple process for investigators to submit a project concept for approval and funding. Applications are reviewed on a rolling basis.

The Academic Drug Discovery Consortium (www.addconsortium.org) was founded in 2012 by leading university-based drug discovery centers to foster collaboration and education across the spectrum of interested parties. Individuals can join for free and be linked to a wealth of useful information.

Private foundations, often disease-specific in nature, have also created programs very similar to PPPs. Examples include the Therapy Acceleration Program of the Leukemia & Lymphoma Society (www.lls.org), the Multiple Myeloma Research Consortium (and other programs) sponsored by the Multiple Myeloma Research Foundation (www.themmrf.org), and the Accelerate Brain Cancer Cure program of the Case Foundation (www.casefoundation.org). These privately funded efforts, often very entrepreneurial in nature, have a high tolerance for risk, are willing to fund big “swing for the fences” ideas, and can make decisions quickly.

It is still too early to assess the impact of the PPP strategy, but these efforts are accelerating transformation of the drug discovery process. Collaboration among commercial and nonprofit entities has historically been challenging, but the evolving drug discovery paradigm requires that these parties commit to new working relationships. PPPs can catalyze the evolution of this new ecosystem.

Getting the facts right

As I have noted already, the constant of failure is central to the rising cost of pharmaceutical R&D. Wasting time and money on a bad target is crippling. A topic of increasing interest and concern is the common experience of published results that cannot be reproduced. Scientists at Bayer reported that the company's in-house experimental data do not match literature claims in 65% of target-validation projects. Similarly, Amgen scientists report that they could not reproduce key results in reports of high interest to their oncology group.26-28

Although the reproducibility problem is not unique to academic research, it is clearly a constant concern that the academic community must acknowledge and work to resolve. To the extent that institutional licensing offices want to make multiple lucrative deals with pharmaceutical companies and venture funds, the buyers must believe that data describing the assets are highly credible.

Several strategies have been initiated to provide an additional layer of validation for ideas coming from nonprofit institutions. Elizabeth Iorns has started the Reproducibility Initiative, a consortium that allows scientists to submit studies to an independent advisory board for possible reproduction. If a project is selected, the scientist provides funding and an independent laboratory conducts the studies. Results can be published in PLoS One.29

Some institutions are establishing their own venture funds to advance in-house discoveries. Partners Health Care, the parent organization of the Brigham and Women's and Massachusetts General Hospitals, has been an early innovator in this area. With 30 million dollars in funding and professional staffing provided by Partners, the fund is able to identify worthy discoveries, conduct due diligence, and partner with outside investors to create companies. This effort clearly provides important validation of the identified ideas, reduces the perceived risk, and attracts outside investors who might otherwise be unwilling to step up.

Academic centers, intent on maximizing the value of their intellectual property, can use contract services to advance internal programs to the clinical. Outsourcing various aspects of drug discovery and development to Asian locations can be a way to reduce costs and save time. WuXi Apptec (www.wuxiapptec.com) and ShangPharma (www.chempartner.cn) are 2 examples of fully integrated Chinese corporations that provide a comprehensive menu of services including small-molecule and biologic drug identification and characterization, early manufacturing, and preclinical testing. By working with these companies, a near virtual enterprise can advance a new drug concept to the point of filing an investigational new drug application.

Although such efforts are not without cost, it may be a good business decision for a large institution or a group of smaller like-minded organizations to consider. Upfront payments, milestone payments, and long-term royalty revenues will be increasingly important to academic institutions as we enter a prolonged period of declining research funding. Efforts that risk-reduce assets will enhance their interest to corporate partners and increase their intrinsic worth and, importantly, happy buyers will be repeat customers.

Conclusions

Risk and failure will continue to be the norm for drug discovery. Learning from failure is not a skill that is easily acquired. In the academic world, we shun failure and failed results are rarely published (except in the form of an occasional retraction). Within the pharmaceutical industry, a “fast to fail” mindset is seen as an efficient way to conserve resources and make good decisions. To suggest that success can be built from failure may be an extreme view; however, it is likely that the rate of progress will improve if the new norm becomes an open discussion of failure rather than keeping failed results a secret.

Medical center–based investigators are uniquely situated to advance drug discovery and improve efficiency. They have direct access to patients, the definitive experimental system in drug research. Currently, human disease is best studied in humans. This is both an opportunity and a responsibility.

Drug discovery is increasingly of interest to academic scientists. As industry tries to address the productivity gap and reduce the inefficiencies of its internal research efforts, opportunities are being created for meaningful collaboration with academic partners.

Disclosures

Conflict-of-interest disclosure: The author is employed by Dyax Inc. Off-label drug use: None disclosed.

Correspondence

Burt Adelman, Division of Hematology, Brigham and Women's Hospital, Boston, MA 02115; Phone: 617-250-5587; Fax: 617-577-9451; e-mail: burtadelman@gmail.com.